After a powerful restoration from December lows, Bitcoin continues to consolidate under a significant resistance cluster. Whereas the value chart exhibits a sequence of clear lows, on-chain knowledge exhibits that the provision to revenue ratio has reset considerably and is now recovering.

Technically, the market is approaching a key determination zone. Both a sustained breakout above the present ceiling opens the door to a brand new leg up, or a rejection right here triggers a correction part in the direction of just lately established help ranges.

Bitcoin Value Evaluation: Each day Chart

On the every day chart, BTC is buying and selling close to the $95,000 resistance band, which coincides with the decrease sure of the broader provide space and the 100-day shifting common. This zone has been performing as a worth ceiling since November and is the principle degree presently being examined.

Under the present degree, an upward construction is shaped from the $80,000 demand zone, forming a sequence of lows. The current rally has pushed the asset from its base into the present resistance space with none vital every day pullback, leaving the $90,000 short-term degree as the primary notable help layer in case of rejection.

The every day RSI has additionally come down from current overbought readings, however stays above the median line, in keeping with the market being in an early or intermediate development fairly than a mature excessive. So long as the high-low construction from the December backside holds, the broader bias on the every day timeframe stays constructive, even when some short-term volatility seems close to resistance.

BTC/USDT 4 hour chart

The 4-hour chart highlights the current breakout from the ascending triangle construction. Value spent a number of weeks compressing between the flat resistance close to $95,000 and the sample’s uptrend line. This resistance is now barely above and the market is consolidating simply above the earlier vary excessive and will goal the $100,000 space subsequent.

Nonetheless, the momentum within the 4-hour RSI suggests a downtrend, reflecting a decline in short-term energy and rising the chance of a correction, or at the very least a sideways consolidation.

If such a correction had been to unfold, $93,000 to $94,000 would kind a direct breakout and retest zone, with stability sustaining the integrity of the bullish breakout. Additional under that, the $90,000 space represents the earlier consolidation band and midrange help, and is a logical space for a deeper however nonetheless wholesome pullback throughout the basic uptrend.

On-chain evaluation

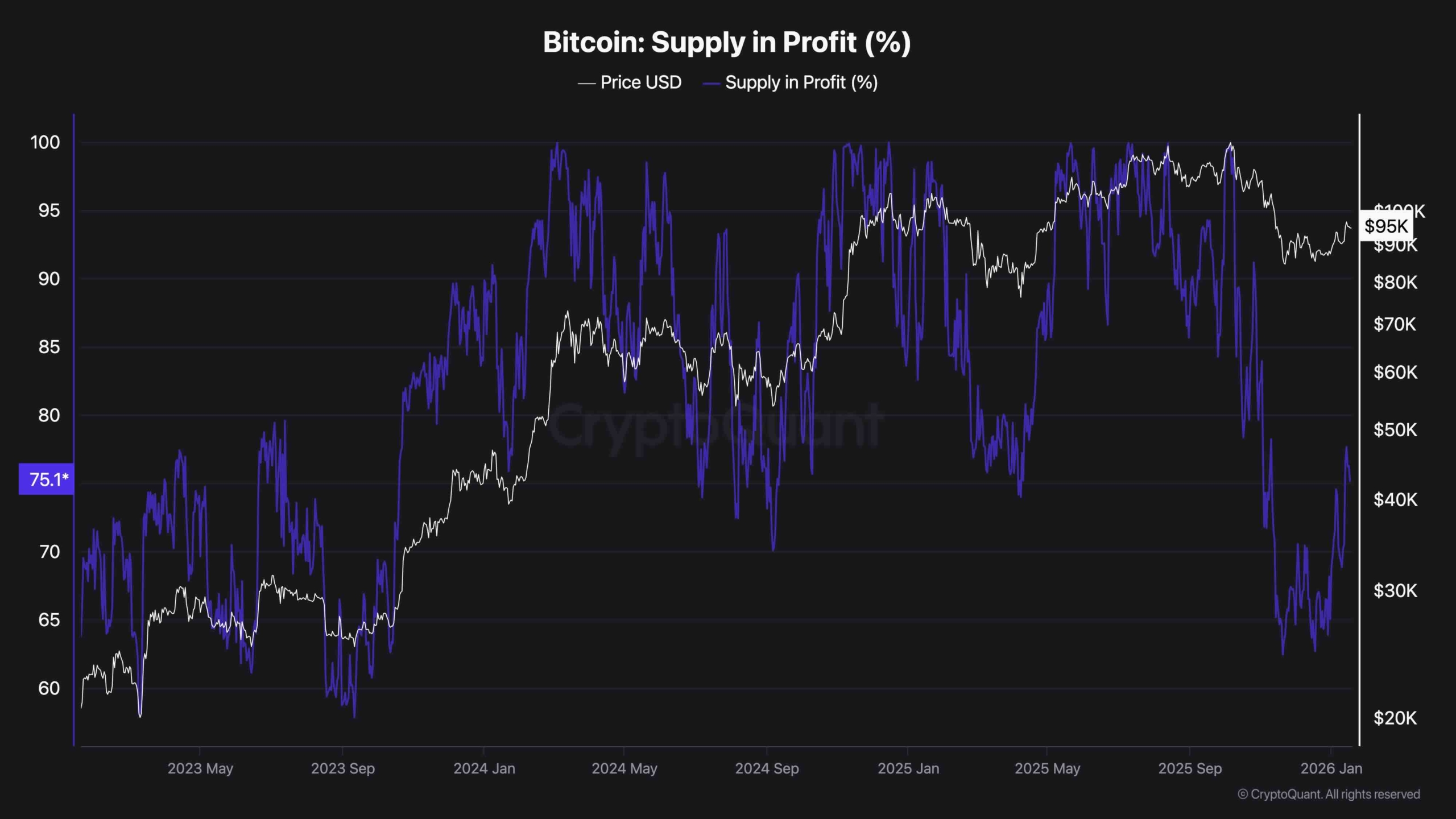

The Revenue in Provide (%) indicator presently offers an necessary cyclical sign. The current distribution fee is BTC Income have fallen to ranges corresponding to these seen earlier within the cycle when spot costs fell under $30,000. This occurred regardless of the present worth being within the $90,000+ space.

Such a major reset in profitability at a a lot greater nominal worth signifies that a big portion of the coin has both modified trades or had unrealized beneficial properties compressed throughout the current correction. Traditionally, comparable resets have usually preceded new medium-term advances as weak palms are washed away and a stronger holder base emerges.

This metric has now rebounded in the direction of the mid-70% vary, suggesting that profitability is enhancing once more however has not but reached the acute ranges (95% and above) sometimes related to the later levels of the euphoria. This mixture may be interpreted as a constructive on-chain backdrop, coinciding with the early levels of a possible new rally, offered that the most important technical resistance on the chart is finally absorbed.

s

s