The Grayscale Chainlink Belief ETF ($GLNK) launched on Tuesday, elevating about $41.5 million in its first day, marking a milestone for U.S. altcoin ETFs.

Institutional demand for publicity to cryptocurrencies is increasing past Bitcoin and Ethereum. Because of this, many buyers at the moment are centered on whether or not LINK can attain new all-time highs.

ETF launch displays rising curiosity from institutional buyers

The Grayscale Chainlink Belief ETF, which trades on the NYSE Arca underneath the ticker $GLNK, is the primary spot Chainlink ETF out there to U.S. buyers. As of Dec. 3, it had internet inflows of $40.9 million on the time of its debut, complete internet belongings of $67.55 million, and quantity of $8.45 million, in response to SoSoValue knowledge. The ETF rose 7.74% to shut at $12.81 per share.

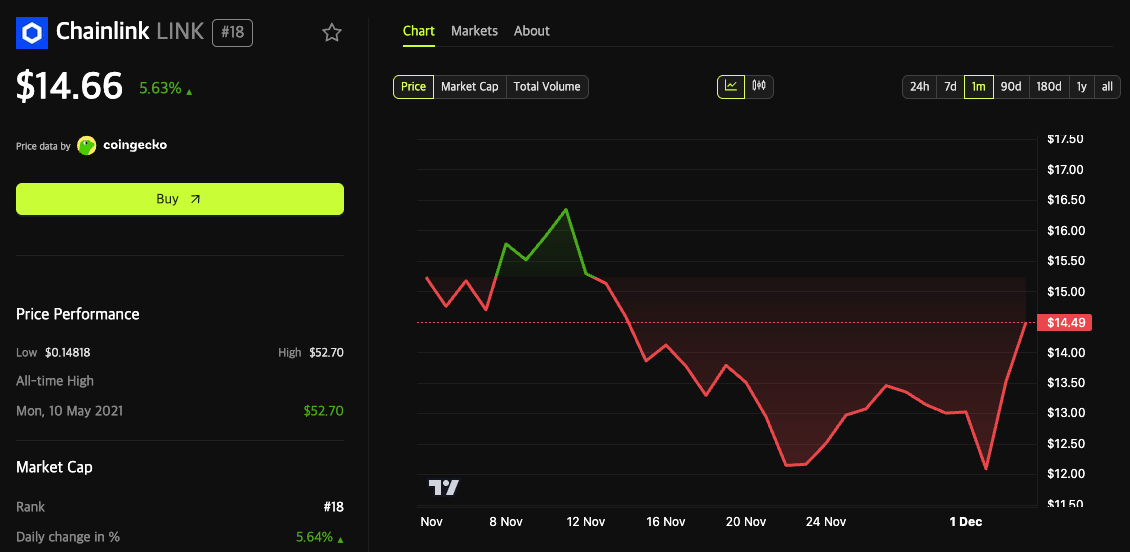

Grayscale transformed its present Chainlink Belief, which was first launched in February 2021, into this ETF. The transfer is according to the corporate’s broader technique and can give academic establishments direct entry to LINK by means of their conventional accounts. On the time of reporting, Chainlink’s native token, LINK, was priced at $14.66.

Grayscale CEO Peter Mintzberg stated the launch is a “clear sign of broad market demand for publicity to Chainlink,” noting rising institutional investor curiosity in Oracle Community tokens. $GLNK posted a robust opening day, turning into one of many best-performing new crypto ETFs because it launched amid heightened market exercise and regulatory adjustments.

Hyperlinks Technical Breakouts and Whale Exercise

Technical analysts imagine that with the debut of the ETF, there can be a big sample change in LINK’s value construction. The token has damaged out of a month-long downward channel. Many observers now imagine this might assist LINK surpass its 2021 highs, as institutional capital flows by means of $GLNK might be the catalyst for a brand new file.

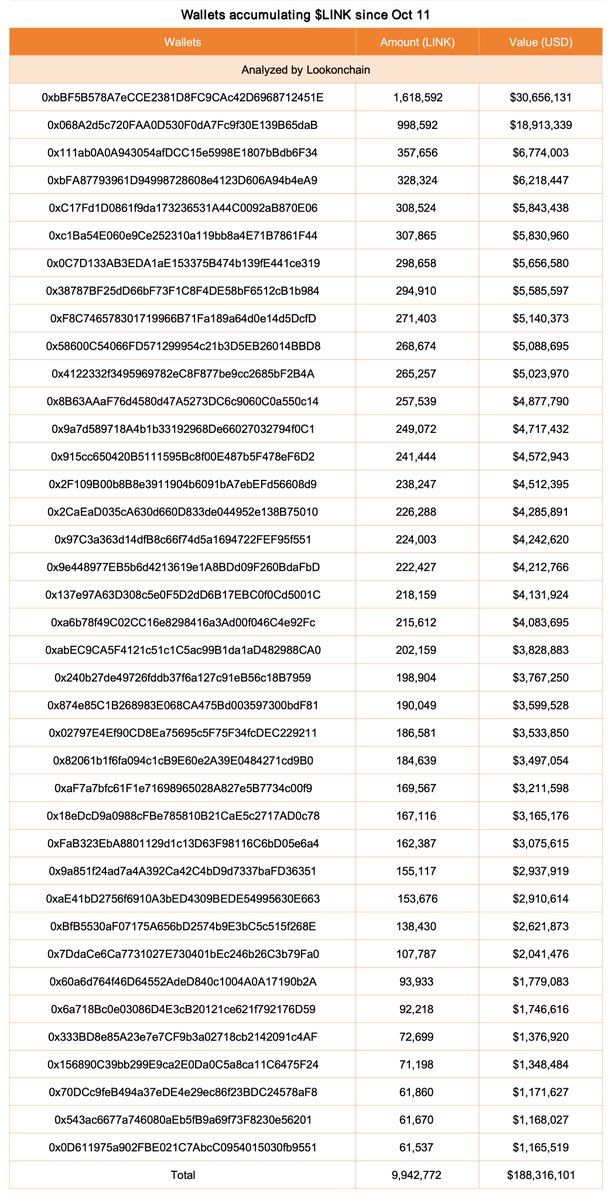

On-chain knowledge highlights huge whale accumulation earlier than and after the ETF launch. Lookonchain reported that 39 new wallets have withdrawn 9.94 million LINK (price $188 million) from Binance for the reason that October market correction. Regardless of current volatility, this motion confirms the arrogance of enormous holders.

LINK whale accumulation since October eleventh. Supply: Lookonchain

However not all massive buyers are benefiting. OnchainLens recognized one deal with that acquired 2.33 million LINKs for $38.86 million over a six-month interval. The whale at present faces an unrealized lack of $10.5 million, making the place price $28.38 million. This case highlights the chance and volatility of LINK accumulation, particularly for early patrons at excessive costs.

Accumulation patterns of particular person whales displaying unrealized losses. Supply: OnchainLens/Nansen

Market dynamics and potential dangers

Open curiosity knowledge after the ETF launch exhibits a combined image. Open curiosity has risen to round $7 million after the earlier drop. This pattern signifies renewed dealer engagement and elevated confidence in LINK’s potential. When value will increase and open curiosity happen collectively, it normally signifies bullish momentum and lively derivatives buying and selling.

However analysts warn that whales that gathered LINK earlier than the ETF’s launch might quickly strategy breakeven or revenue targets. If these holders promote, promoting strain might restrict short-term positive aspects regardless of sturdy institutional inflows. Merchants are watching LINK because it exams resistance, ready for extra momentum and weighing optimism in opposition to a attainable reversal.

The ETF’s outlook is dependent upon whether or not institutional demand meets potential whale gross sales and continues to draw capital. Each breakouts and corrections stay attainable as technical breakouts, whale accumulation, and open curiosity rise alongside file ETF inflows. Market members can be watching to see if LINK maintains its upward momentum or if profit-taking prompts a correction earlier than hitting new highs.

The put up $41 million poured into First LINK ETF: Will Chainlink lastly break by means of ATH? appeared first on BeInCrypto.