Ethereum value continued its downward pattern for the fifth day in a row, dropping greater than 11% up to now 24 hours amid a large liquidation of bullish bets and whale promoting. As macroeconomic issues proceed to cut back danger urge for food, will belongings fall beneath $2,000 subsequent?

abstract

- Ethereum’s value fell to an eight-month low of $2,172 on Monday.

- Large liquidations of bullish bets and whale gross sales compounded losses.

- A number of bearish patterns have been confirmed on the day by day chart.

In line with information from crypto.information, Ethereum ($ETH) Costs fell 11% on Monday morning Asian time to an eight-month low of $2,172, earlier than stabilizing at simply above $2,200 at press time. The decline widened losses to greater than 25% from Thursday’s excessive of about $3,000.

Ethereum’s value fell as large liquidations hit the crypto market, however a lot of that was because of the main cryptocurrency shedding a key help degree, wiping out some very bullish bets. Notably, Bitcoin fell beneath the $80,000 threshold and Ethereum misplaced help at $2,800 and fell additional in the direction of the $2,600 vary.

In line with information from CoinGlass, greater than $757 million in leveraged positions have been liquidated throughout crypto markets, with the bulk coming from prolonged liquidations. Lengthy Ethereum merchants confronted the brunt of the ache with $213.59 million liquidated up to now 24 hours and almost $182.34 million liquidated throughout the first 12 hours.

Liquidation of lengthy positions tends to create compelled promoting strain. A wave of liquidations that started over the weekend, with over $2.4 billion of longs liquidated, continues to frighten merchants and preserve them out of the market.

You might also like: Will the cryptocurrency market get better because the decline intensifies?

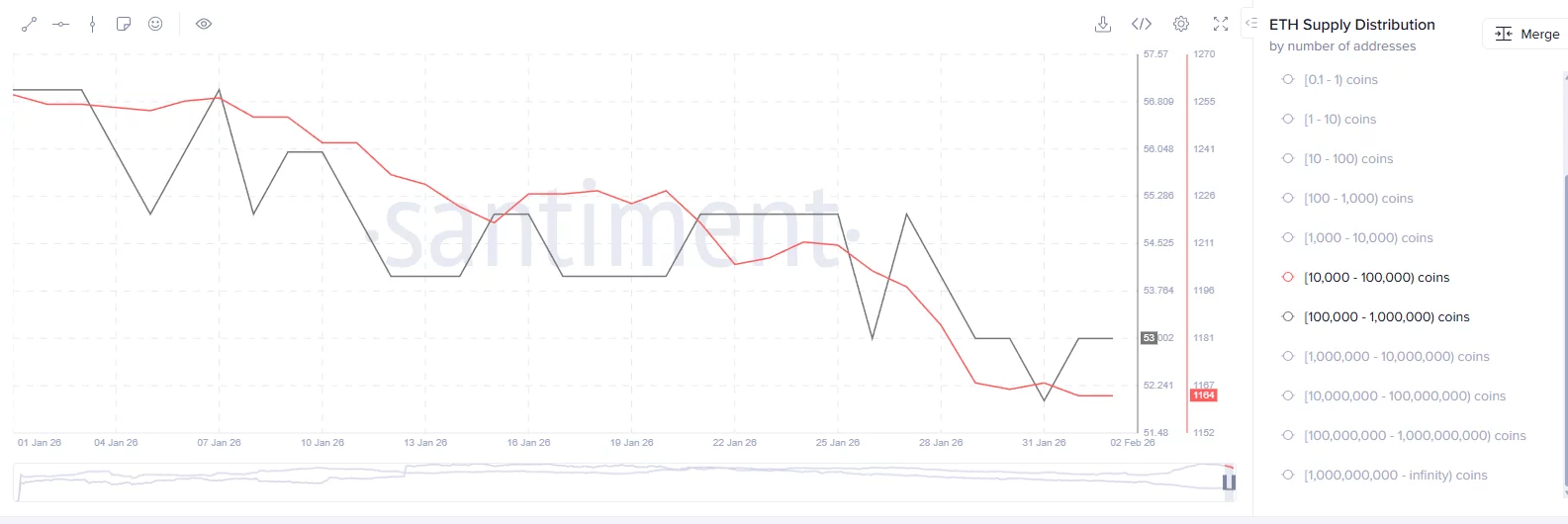

One other main cause why Ethereum is plummeting is promoting strain from whales. Specifically, it’s dwelling to between 10,000 and 1 million whales. $ETH offered billions of {dollars} value $ETH In line with Santimento information, up to now week.

$ETH over the previous week. “>

$ETH over the previous week. “>

Whales have been offered $ETH Previous week |Supply: Santiment

On the similar time, almost $327 million has been drained from Ethereum ETFs over the previous week as institutional buyers decreased their publicity.

Such massive sell-offs are likely to trigger retail panic, resulting in extra compelled exits and additional losses, a minimum of within the brief time period.

On the macroeconomic entrance, market expectations modified after US President Donald Trump nominated Kevin Warsh to be the following Chairman of the Federal Reserve Board. Warsh is extensively seen as a hawk by cryptocurrency supporters attributable to his historical past of advocating for monetary self-discipline.

Moreover, the partial U.S. authorities shutdown that started early Saturday morning added to the stigma for buyers, creating an information vacuum and stalling regulatory progress.

Ethereum, together with different main crypto belongings together with Bitcoin (BTC), has plummeted since these developments.

Ethereum value evaluation

On the day by day chart, Ethereum value has confirmed a breakout from an ascending wedge sample, a bearish configuration with two ascending and converging traces, which has traditionally been adopted by a pointy pattern reversal and a major value decline.

Ethereum value confirms a number of bearish patterns on day by day chart — February 2 | Supply: crypto.information

Following the breakout, $ETH Costs then fell beneath the neckline of the a lot bigger inverted cup-and-handle sample that shaped from mid-2025 onwards. Inverted cups and handles are among the most bearish patterns in technical evaluation and sometimes point out the continuation of a long-term downward trajectory.

Confirming each of those bearish patterns, it is extremely doubtless that Ethereum will proceed its downtrend and will lose the psychological help degree of $2,000 if the promoting strain continues.

Momentum indicators comparable to MACD and RSI help the bearish forecast. The MACD line was pointing down whereas the RSI fell into oversold territory. An oversold RSI sometimes suggests a reversal could also be within the works, however any short-term aid positive factors might be tempered by prevailing bearish sentiment throughout the sector.

On the time of writing, the Crypto Worry and Greed Index rating is 14, putting the crypto market throughout the excessive concern degree.

Disclosure: This content material is offered by a 3rd social gathering. Neither crypto.information nor the writer of this text endorse any merchandise talked about on this web page. Customers ought to conduct their very own investigation earlier than taking any motion associated to the Firm.

learn extra: CME Bitcoin futures open with second-largest hole in historical past at $6.8 million