Ethereum costs It holds previous the $4,200 mark after an explosive summer time rally, however the subsequent transfer is greater than only a chart. With Federal Reserve Chairman Jerome Powell making ready for a remaining Jackson Gap speech, political stress from President Trump and elevated tariffs for the US financial system, crypto traders are asking for one essential query. Will ETH costs crash?

Macro background: Powell, tariffs, rates of interest

The very best Federal Reserve policymakers have closed their doorways to hopes of charge cuts in September, pointing to cussed inflation and nonetheless sturdy labor markets. With out selling mitigation, the Fed sign a extra extreme state of affairs for longer. It’s a set-up of cryptographic parts, which normally come collectively when financial coverage modifications slowly. As a substitute, merchants stare at excessive charges and restricted liquidity. This might doubtlessly drag each Bitcoin and altcoin quickly.

The Fed is strolling the tightrope. Inflation stays rising, tariffs are placing new upward stress on client costs, and Trump is demanding decrease charges forward of the September coverage assembly. Traders can be break up on whether or not the Fed will present rate of interest reductions or maintain them regular. Powell is unlikely to tilt his hand to Jackson Gap. Which means the market could also be inferred till information arrives.

This uncertainty is essential for Ethereum. Rate of interest reductions are inclined to gas threat belongings like crypto by rising liquidity and decreasing capital prices. Nevertheless, if the Fed doubles fight inflation, capital will return to bonds and {dollars}, and ETH can be beneath stress.

Ethereum value forecast: The place is the state of affairs proper now?

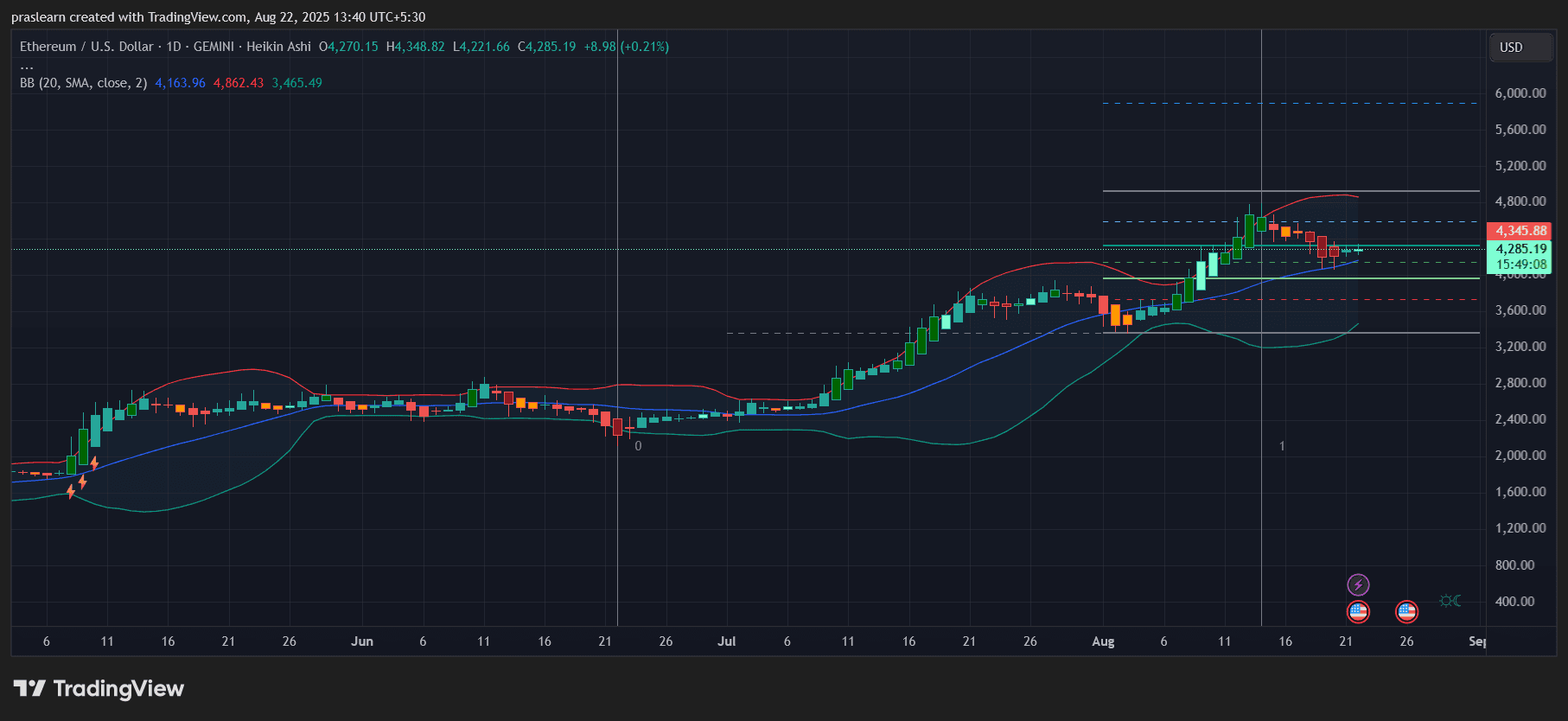

eth/usd each day charts – TradingView

The ETH Day by day Chart exhibits that Ethereum is consolidating a consolidation of beneath $4,300 after testing a resistance of almost $4,600 originally of August. The value sits across the midline of the Bollinger band, suggesting a post-race cooling interval from the $3,200 stage in June.

Vital technical ranges to take a look at:

- Instant resistance is positioned between $4,350 and $4,400, in keeping with latest failed breakout candles.

- The higher bollinger band, which is round $4,860, is the following bullish goal if momentum reigns.

- Sturdy assist is round $4,100, and deeper safety is $3,650 if the repair is prolonged.

The truth that ETH holds the breakout zone about $4,000 above signifies that consumers are nonetheless in management, however the tempo has slowed down.

Will ETH costs crash or stabilize?

The short-term dangers are clear. If Powell suggests Hawkish’s keep and inflation information is scorching, dangerous belongings may very well be offered out. That state of affairs may pull ETH again into the $4,100-$3,650 assist zone. Nevertheless, this nonetheless does not appear to be a crash setup. ETH continues to be on the upward pattern, with no larger lows and better highs.

A real crash requires each a macro tightening and a technical collapse of beneath $3,650. That stage is a line within the sand of a bull. So long as the ETH stays above it, the pullback seems to be like a wholesome correction inside the wider bull cycle.

Ethereum value forecast: Unbalanced actions happen first

The following 30 days of Ethereum can be about actions on the chain, and the way the Fed balancing act will work. If Powell suggests future mitigation, ETH may retest $4,800 and goal for $5,200. If he highlights the chance of inflation and avoids decreasing signaling, ETH could shatter or drop September sideways.

In any case, ETH is unlikely to crash fully until the macro impression is alongside the technical breakdown. For now, the market stays cautiously bullish, Jackson Gap for clues.