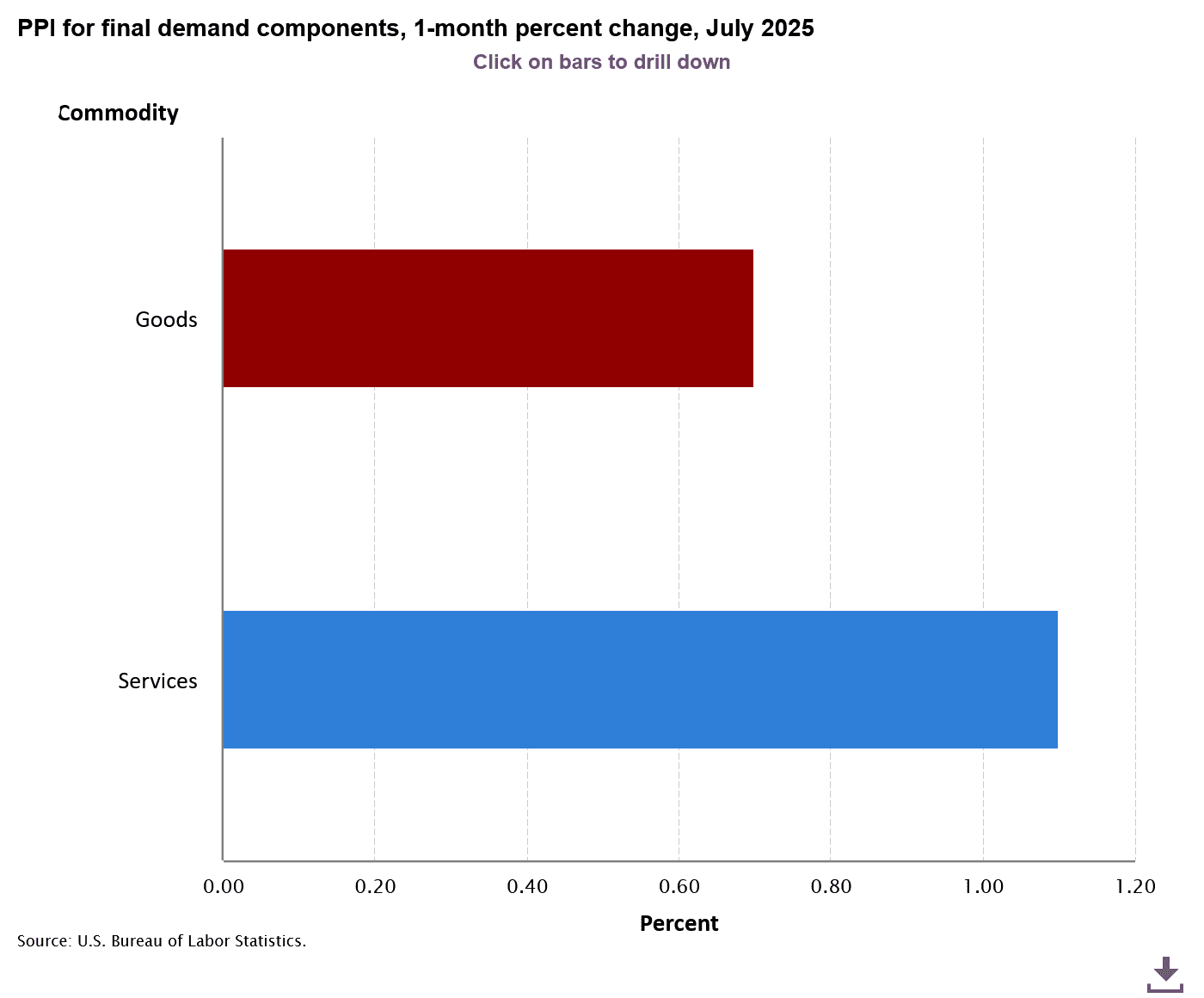

The US labor market clearly reveals indicators of stress. The Federal Reserve is beneath stress to behave as employment progress weakens and client sentiments level to a rise in unemployment. Economists hope that not less than one fee shall be lower in September and extra shall be tracked by the tip of the yr.

Nevertheless, the market is already priced with a deeper easing cycle, and we hope that the Fed will decrease the speed to the three.5-3.75% vary by December. This might scale back borrowing, pump liquidity into dangerous belongings, and improve cryptocurrency. However there is a catch. Inflation is sticky at round 2.9%, and tariffs are quietly creeping as much as client costs. When inflation burns, the Fed can decelerate its easing pathway and fall into market enthusiasm.

The background of this macro is essential in the case of Ethereum costs. Usually, decrease charges improve progress demand and threat belongings like ETH, whereas inflation threat ends in volatility. Buyers want to look at CPI prints as intently as they’d take a look at the ETH chart.

Present Value Actions for Ethereum: Pre-Break Compression

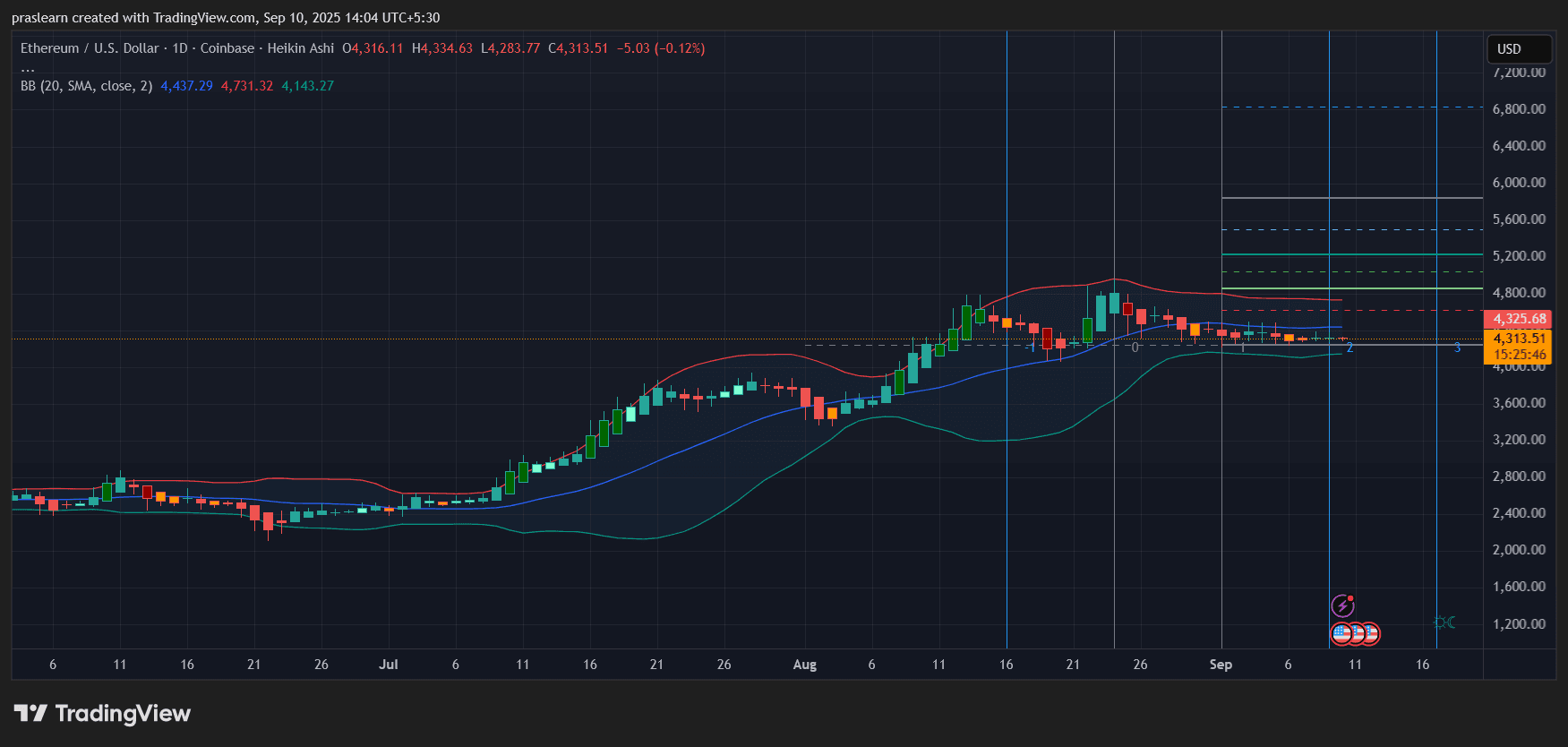

eth/usd day by day charts – TradingView

The Ethereum Value trades for round $4,313 and sits in the midst of the choking of a bollinger band. Volatility has been compressed sharply since late August, and textbooks present that there’s a massive breakout. The higher bollinger band is near $4,731 and the decrease restrict is round $4,143, so it’s worthwhile to mark a direct vary ETH.

Latest worth motion reveals that ETH costs have been consolidated after the July-August rally, with consumers defending the $4,100 zone. This integration has created a base that’s barely above the 20-day transferring common. This implies accumulation slightly than distribution. Nevertheless, if you cannot maintain $4,100, you will open up a destructive facet threat to $3,800.

On prime, breakouts above $4,750 may set off a $5,200 rally in direction of the Fibonacci growth degree and $5,600 if Momentum matches Fed-driven liquidity.

Ethereum worth forecast: What ought to buyers anticipate?

The subsequent few weeks shall be essential for ETH as a result of alignment of macroeconomics and know-how.

- If the Fed cuts by 0.25% in September And extra mitigating alerts may probably enable ETH to interrupt out of the built-in zone, protecting the $5,200-$5,600 vary.

- Restrict the Fed’s conduct if inflation information is stunning largerETH stalls beneath $4,750 and dangers revisiting help of $4,000-$3,800.

- Extra aggressive 0.50% Fed Lower Turbocharges can pose dangers and ignite a breakout rally of $6,000 by the fourth quarter.

The true driver is how markets interpret the Fed’s stability between inflationary consideration and labor weak spot. ETH costs can earn cash if buyers imagine that the Fed will make a mistake on the expansion facet.

Funding Outlook: Persistence earlier than positioning

Ethereum worth is a sport at present on standby. With the Bollinger Band compressed and the Fed’s resolution looms, merchants should be ready for prime volatility. A disciplined method is to watch breakout confirmations that exceed $4,750 lengthy earlier than, with the outage degree set at practically $4,100. Nevertheless, long-term buyers might contemplate themselves immersed in $4,000 as a chance to build up earlier than the subsequent liquidity-driven gathering.

What this actually means is that $eth is sitting at a macrotechnical inflection level. The Fed’s subsequent transfer may unlock the subsequent leg from $5,600 to $6,000 or power $Ethereum to a deeper retest of $3,800. In any case, the present integration is not going to final very lengthy.