Markets thrive on certainty, and for the previous 40 days, all anybody has felt is uncertainty. The US authorities shutdown has choked liquidity, disrupted capital flows and depleted threat urge for food. The Senate’s 60-40 vote to advance the bipartisan settlement is an actual step towards reopening, and merchants are celebrating.

Analysts say the federal government shutdown has tightened the in a single day funding market and elevated volatility. Now {that a} deal is in sight, traders are turning to riskier property comparable to cryptocurrencies in anticipation of financial easing and elevated fiscal spending forward of the midterm election yr.

This mix of easing political stress, expectations for fiscal stimulus, and a weaker greenback tends to create a perfect atmosphere for property like Ethereum, which regularly monitor threat sentiment and liquidity cycles.

Ethereum value prediction: Indicators of a short-term reversal

ETH/USD each day chart- TradingView

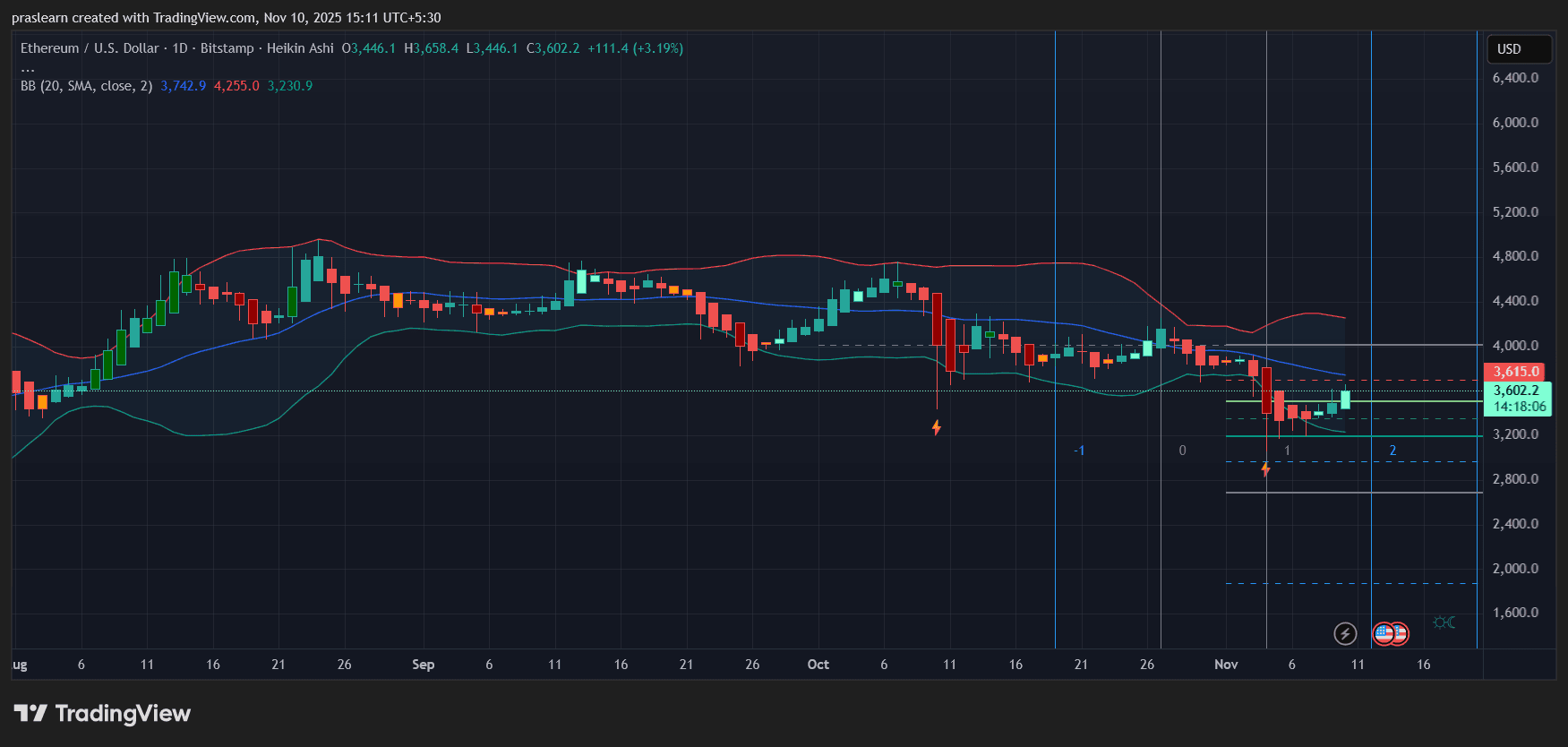

On the each day Heikin Ashi chart, we are able to see that Ethereum has rebounded strongly from the decrease assist of the Bollinger Bands round $3,230. The present candlestick is inexperienced, with a protracted physique and minimal wick, indicating continued bullish momentum after an prolonged correction section.

Ethereum value has regained the mid-band area round $3,600, suggesting {that a} reversal sample may kind after the latest lows. The following technical take a look at lies close to the highest of the Bollinger Band at $4,255, which is roughly in step with the psychological resistance close to $4,200.

The 20-day easy shifting common (SMA) is close to $3,742, offering the primary short-term resistance. A definitive each day shut above this degree will doubtless verify a breakout and entice momentum patrons aiming for the $4,000-$4,200 vary.

If this transfer fails, fast assist stays at $3,230, with a deeper retracement doubtlessly discovering footing close to $3,000. This is a crucial spherical quantity and a Fibonacci assist degree from the earlier swing low.

Market sentiment and momentum outlook

A Heikin Ashi pattern reversal coincides with a discount within the underlying volatility of the Bollinger Bands, and this sample usually precedes sharp directional strikes. The final time Ethereum’s value fell this drastically, it had a 20% breakout inside just a few days.

Quantity has additionally began to select up, suggesting new participation from inactive merchants. With broader macro sentiment enhancing and a political resolution in sight, Ethereum may see a wave of quick overlaying that accelerates this rally.

Nevertheless, merchants ought to take word. A setback in closure negotiations or a delay in proceedings within the Home of Commons may set off a profit-taking transfer. Cryptocurrency markets stay hypersensitive to macro headlines, particularly when liquidity expectations change.

Ethereum value prediction: what is going to occur subsequent week

If the Senate settlement passes easily and the Home follows go well with with none confusion, Ethereum may keep momentum in the direction of the $3,850-$4,000 zone by midweek. In that situation, the market narrative would shift from concern to optimism and Ethereum may take a look at the 100-day SMA as the subsequent resistance cluster.

Conversely, if political tensions flare up or the vote stalemates, ETH value may shortly revisit the $3,300-$3,250 assist space, and patrons are prone to defend their positions.

For now, our bias stays cautiously bullish. A mix of macro optimism, technical restoration, and enhancing market liquidity places Ethereum on monitor for a near-term rally, however merchants ought to maintain an in depth eye on $3,742. That’s the dividing line between restoration and relapse.

Ethereum’s latest surge isn’t just a spike in cryptocurrencies, however a mirrored image of fixing macro traits. With the political deadlock easing and threat urge for food returning, ETH value is positioned to regain its highs if it might shut decisively above $3,742. Political developments within the US over the subsequent 48 hours may decide whether or not Ethereum extends this transfer in the direction of $4,200 or pauses for consolidation.

As soon as the federal government formally reopens this week, we anticipate the ETH narrative to show from defensive to opportunistic, doubtlessly seeing $4,000 arrive before most anticipated.