Bitcoin costs have fallen 26% over the previous month, dropping from a January excessive of $97,682 to round $67,190. It has struggled to get well, making many traders nervous. Regardless of sturdy institutional shopping for and robust international liquidity, Bitcoin’s worth nonetheless lags behind property similar to gold and silver.

Lack of Bitcoin provide and worry of quantum computing

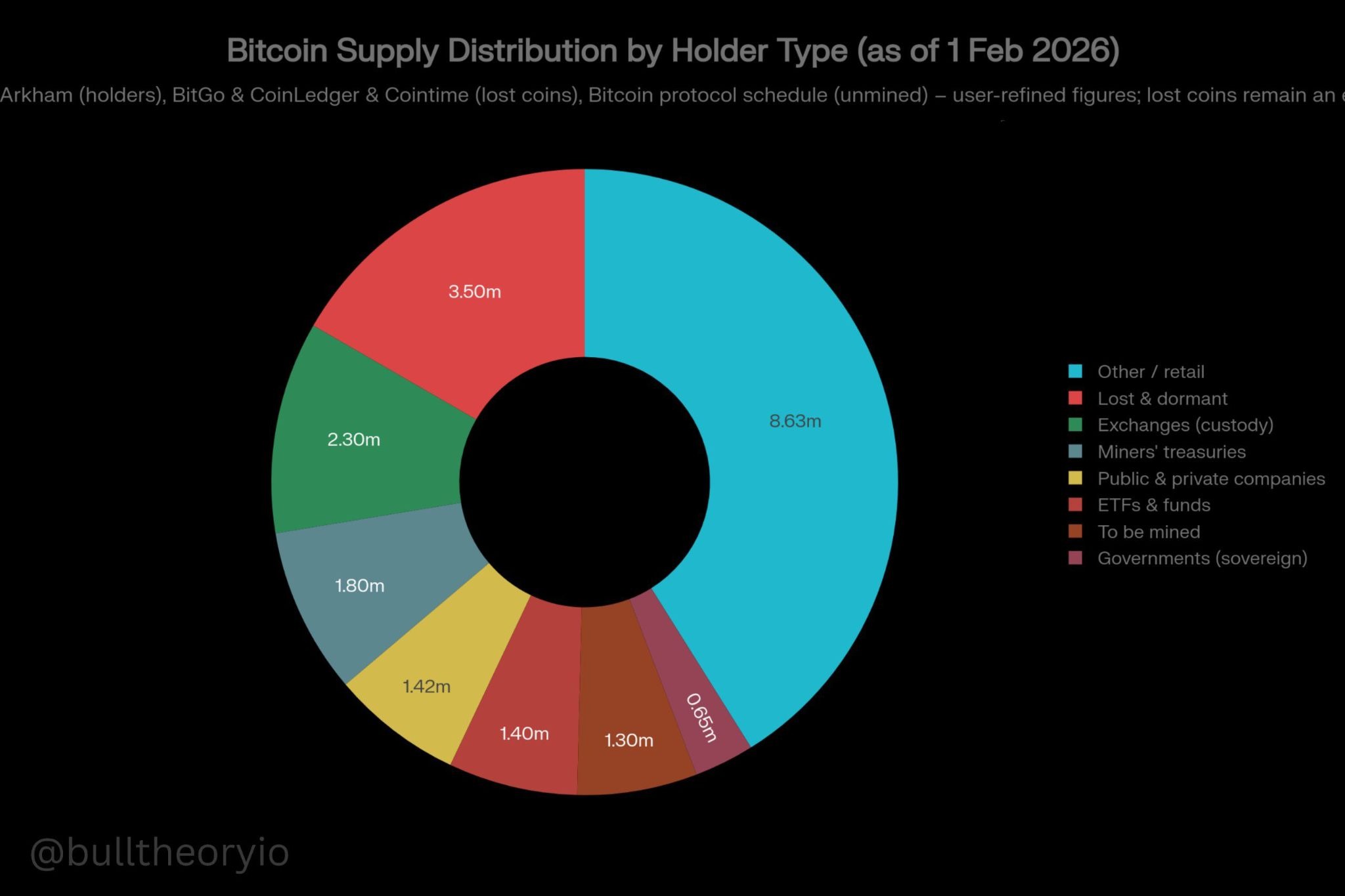

One of many main considerations affecting the worth of Bitcoin is the big variety of lacking or invalid cash. Cryptocurrency specialists estimate round 3.5 million to 4 million $BTCvirtually 18% of the overall provide has not been moved since Bitcoin’s early days and is believed to be misplaced perpetually.

Analysts imagine that maybe fast advances in quantum computing may make it simpler to entry these previous wallets sooner or later. Even when this danger will not be confirmed, the market will react to such a risk.

If traders anticipate a few of these cash to return, it may improve future provide uncertainty and put strain on Bitcoin’s value.

Institutional purchases compensate for loss in Bitcoin provide

Apparently, institutional traders have been actively shopping for Bitcoin in recent times. For the reason that launch of the Spot Bitcoin ETF, establishments and corporations have collected roughly 2.5 million to three million $BTC. This quantity is roughly equal to the variety of cash believed to have been misplaced.

Which means that whereas new demand exists, considerations about future provide returning are counteracting any bullish momentum. Because of this, Bitcoin has not seen the sturdy value improve that many have been anticipating.

Huge redistribution of Bitcoin will increase promoting strain

In accordance with on-chain information, roughly 13-14 million $BTC has already moved into this market cycle, marking the biggest redistribution in Bitcoin historical past.

Regardless of this huge transfer, Bitcoin didn’t expertise a whole crash. This reveals that the market has already absorbed a considerable amount of provide.

Because of this, there are considerations that the variety of folks will improve by one other 3 to 4 million folks. $BTC The affect of a future return could also be smaller than many anticipate.

Bitcoin value liquidation causes market panic

Bitcoin costs additionally reacted to the Fed’s determination to maintain rates of interest on maintain. This elevated strain in the marketplace. Roughly $223 million was final liquidated, in response to Coinglass information.

In the meantime, $78 million was liquidated in Bitcoin alone after it fell under the essential 200-week EMA degree close to $68,000.

In the intervening time, Bitcoin is buying and selling round $66,900, indicating continued weak point in market momentum.