abstract

- Bitcoin value forecast analysts say BTC is buying and selling at a low stage as much as $114,000, following the rally in late September.

- The Spot-ETF circulate is blended. Earlier weekly withdrawals had been important, however there was a each day new inflow of latest sure US ETFs.

- Main Brief-Time period Vary: $108K-$116K; Breaks above the vary result in $118k to $120,000 (or in a long-term rally).

- A breakdown under $108K will increase your probabilities of shifting under $105K.

- Adjustments within the structural market, reminiscent of elevated derivatives, will improve the volatility of each upward potential and tail threat for open amenities of excessive curiosity (reminiscent of IBIT).

Bitcoin value forecasts are centered as Bitcoin recovered within the second half of the turbulent interval after the turbulent interval in September.

This motion displays a mixture of variables, together with generally extra fluid and ejected Spot-ETF flows, important on-chain accumulation by key holders, and the development of by-product areas shifting round in both route.

Crypto market analysts are intently monitoring whether or not the rally in late September will pave the best way for a sustainable fourth quarter advance or just pave the best way for an additional volatility.

desk of contents

Bitcoin Worth Prediction: Present Situation

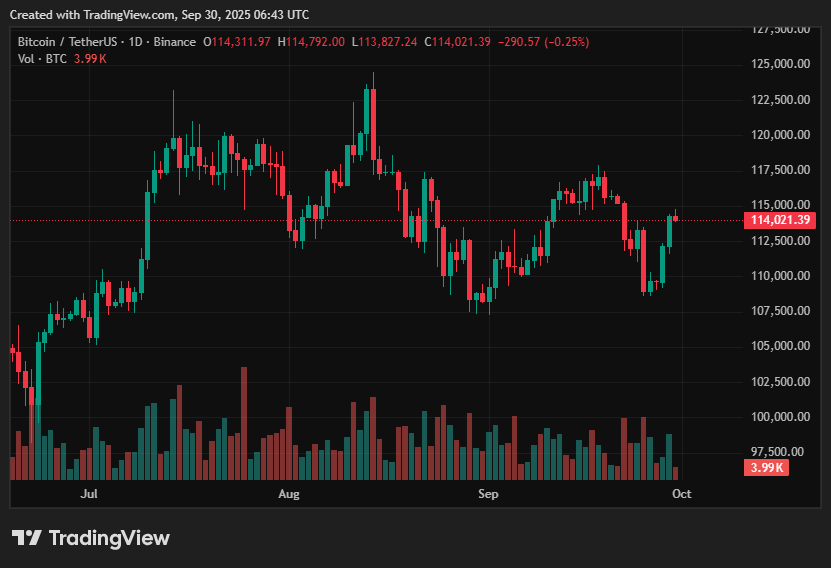

BTC 1D chart, supply: crypto.information

Bitcoin is presently buying and selling within the area from $114,000 to March after a rise in quantity and bids. Worth provide and up to date studies will set the degrees to $114.4K-$114.6K.

Markets deal with conflicting capital flows. Though weekly information revealed a major withdrawal from pooled merchandise earlier this month, through the day and product-level actions had been inconsistent.

On the identical time, open curiosity in choices and futures has surged, with venues throughout the facility (notably IBIT) quickly increasing their presence within the derivatives market, leading to structural adjustments that change how liquidation and Gunmask Eases unfold.

All of those are layered above the common technical zone. The market has discovered assist at a low $100,000 vary throughout a latest fall and is presently encountering clustering resistance within the $113K to $116K band, the place provide is concentrated lately.

You may prefer it too: When the CME futures hole opens, Bitcoin value faces pullback threat

The wrong way up perspective

Conversely, clear breaks and retention above the $116K stage enhance the chart construction, winding up leveraged brief positions, and probably speed up the push to the $118K-$120K zone as ETF demand will increase internet purchases.

Presently, some market commentaries identifies This fall as a window during which sustained institutional allocations can considerably reassess costs, assuming that flows proceed favorably. In such a situation, a number of analysts sketch out fairly huge year-end targets and work with a cautious bullish BTC value forecast.

Moreover, massive on-chain accumulation by long-term and facility whales, in addition to the decline in alternate balances in latest snapshots, helps circumstances of higher motion when patrons are extremely trusted.

The chance of drawbacks

The unfavourable situation for Bitcoin (BTC) is evident. Failure to carry a low $108k assist zone will possible expose the $10,000 stage to recent gross sales strain, with 105ka $105ka reaching an inexpensive close to objective with a deeper decline. Brief-term dangers embrace sporadic ETF spills, miners or alternate gross sales, community replace disputes, and macro shocks (central financial institution speeches or sudden risk-off occasions).

The traditionally unfavourable seasonality of September, coupled with the chance of brief, speedy liquidation when derivatives positions are concentrated at key ranges, means that rising interior volatility is anticipated, even when the broader Bitcoin outlook is supportive.

You may prefer it too: Bitcoin Worth Rebound Sign This fall Rally Begins, $180,000 Play by the Finish of the Yr: Evaluation

Bitcoin value forecast primarily based on present ranges

BTC Assist and Resistance Ranges, Supply: TradingView

Given the present construction and circulate, the short-term value vary for the surgical procedures to observe is between $100,000 and $1.16 million. As Bitcoin can keep motion past its vary, the expanded Bull situation will push costs as much as over 120 ks as facility allocation accelerates.

In distinction, clear breaks under $108K could improve the chance of a slide to $105K and resume decrease targets when macroeconomic situations worsen. General, the stability of proof suggests a cautious bullish tilt that’s topic to additional ETF absorption and lack of enormous, disorderly gross sales, however merchants have to predict elevated volatility realized as a change in perspective.

This creates short-term turbulence expectations whereas sustaining a broader bull projection in the direction of increased value ranges when supportive flows persist.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.