Ethereum stays in a corrective range-bound surroundings after failing to maintain positive factors above the mid-$3,000s in the beginning of the month. Worth motion has been oscillating between the next timeframe demand cluster close to $2,700 and a broad provide band close to $3,500, however the main transferring averages proceed to cap the upside.

This construction leaves directional confidence restricted and will increase the significance of reactions in close by help zones in the course of the present pullback.

Ethereum Worth Evaluation: Every day Chart

On the each day chart, Ethereum Rejected as soon as once more from the confluence of the $3,500 resistance block and the falling 100-day transferring common, the 200-day stays at highs close to $3,800, turning sideways. The decline under the 100-day transferring common confirms that the primary pattern stays corrective fairly than impulsively bullish, and focus shifts to the inexperienced $2,700 demand space as the following key space.

A sustained break above that zone would preclude any bearish continuation and go away open the potential for one other try in direction of the $3,500 mark. Then again, a each day shut under the $2,700 zone would point out a deeper imply reversion in direction of the decrease help band round $2,200.

Ethereum/USDT 4 hour chart

The 4-hour chart reveals a transparent breakdown of the ascending channel that carried the worth from round $2,800 to its current peak close to $3,400. After dropping the channel flooring and native help round $3,000-$3,100; Ethereum is at present buying and selling in a transparent downtrend characterised by decrease highs and decrease lows, with momentum indicators such because the RSI solely marginally recovering from oversold territory.

The fast tactical axis is situated close to the earlier breakdown zone between $3,000 and $3,100. A restoration and consolidation above this space would sign a failure of the collapse and pave the best way again to $3,400. Then again, if the rejection there continues, we are going to see stress on the help stage nearer to $2,900 after which demand for larger timeframes between $2,600 and $2,700.

sentiment evaluation

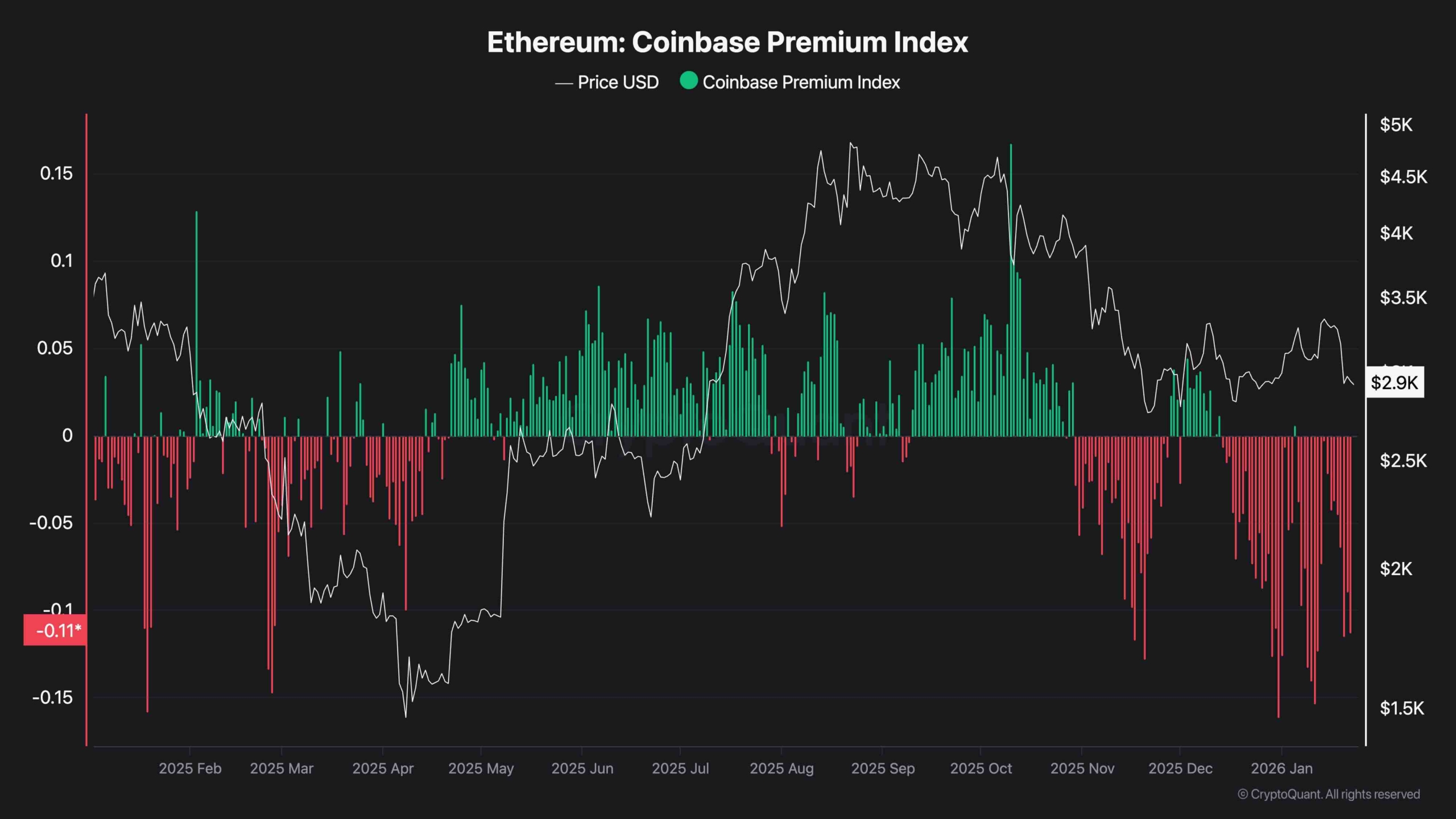

Ethereum’s Coinbase Premium Index has turned decisively adverse in current weeks, and the persistent crimson numbers point out that Coinbase’s spot value is buying and selling at a reduction in comparison with Binance. This composition signifies comparatively weak buy-side curiosity from US and institutional-leaning contributors, typically in line with distribution stage or cautious positioning in that cohort.

On the identical time, the traditionally widening adverse premium could coincide with the depletion of native promoting stress as weaker fingers succumb to extra aggressive offshore demand, setting the stage for a restoration as soon as macro liquidity and narrative drivers enhance. However for now, the continued decline helps the view that the present decline is pushed not solely by technical rejection at resistance ranges, but additionally by a conservative bias in US spot flows.