Bitcoin recovered the $120,000 mark, signaling the crypto king to the very best ever.

The sharp rise in costs displays improved buyers’ sentiment as contemporary capital flows into the market. Medium-sized homeowners and ETF inflows appear to play an vital function.

Bitcoin has robust assist

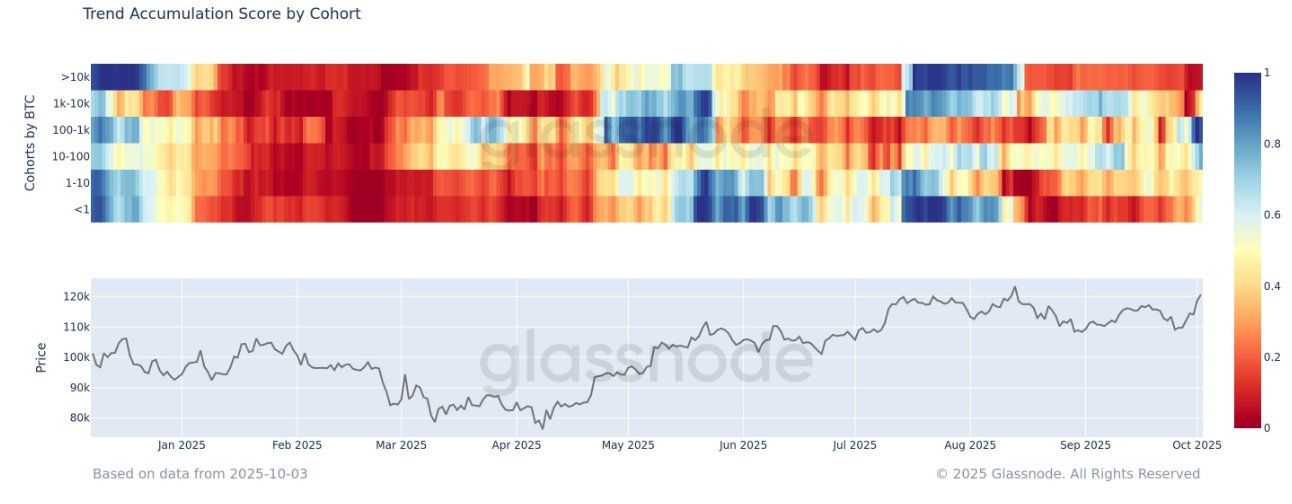

Pattern accumulation scores spotlight important modifications in market situations. Medium-sized Bitcoin holders have a robust accumulation, offsetting the continuing gross sales by massive entities. This contemporary wave of demand reveals structural assist for BTC’s present uptrends, making a extra secure basis for future earnings.

The distribution of whales has slowed down, however the fewer buyers stay largely impartial. This steadiness reduces the chance of aggressive gross sales and enhances market resilience. Adjustments in investor conduct recommend a more healthy surroundings for Bitcoin development.

Bitcoin Pattern Accumulation Rating. Supply: GlassNode

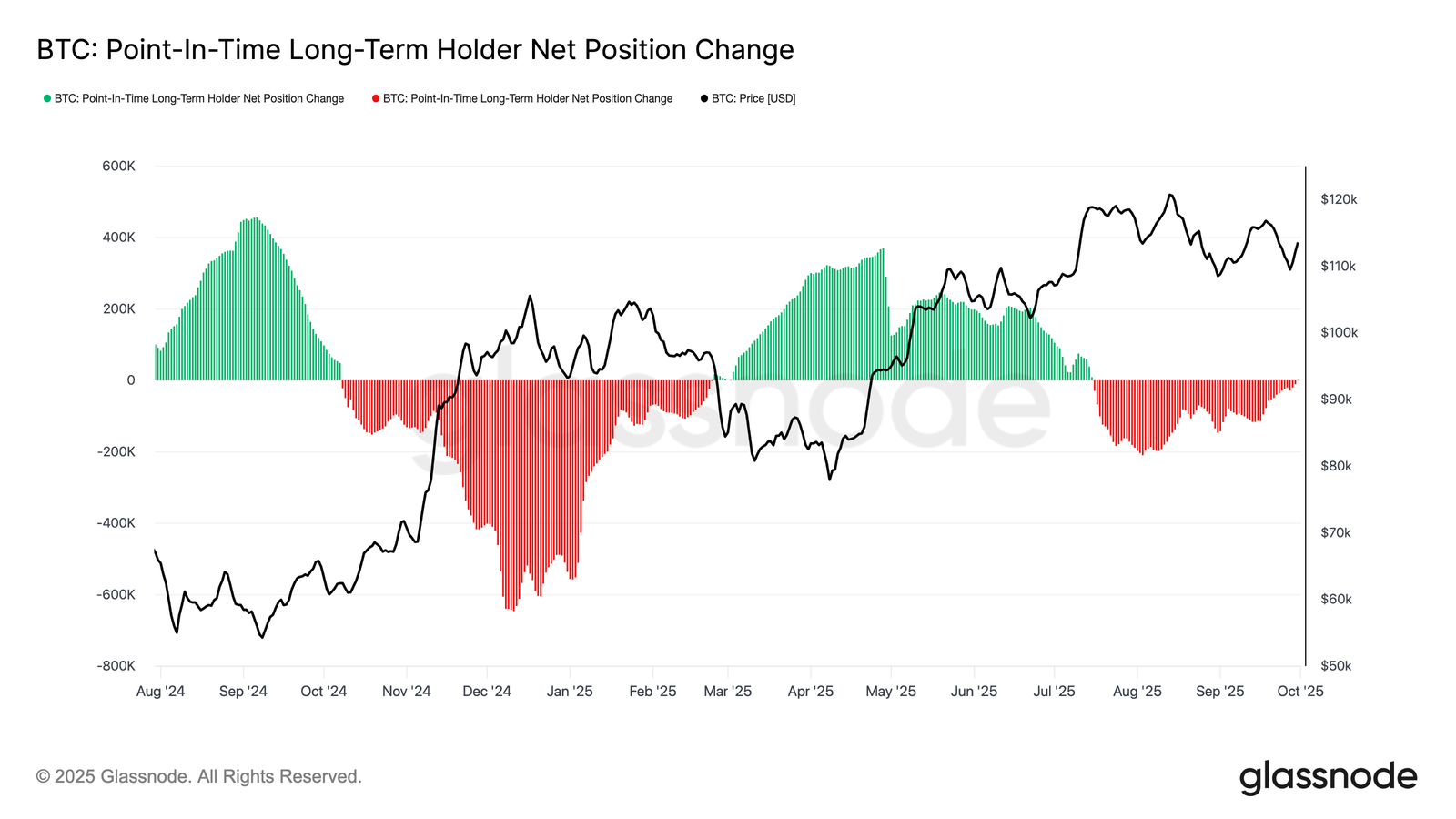

Internet place modifications for long-term holders (3D) shifted to impartial after a number of months of mass distribution. This implies that revenue good points from long-term holders have been cooled down, lowering their vulnerability to sharp gross sales pressures available in the market. Lowering distribution is an inspired indication of sustained worth depth.

With diminished provide stress, exterior elements equivalent to ETF inflows and institutional demand might take the lead as they acquire momentum. If these influxes are constant, they may proceed the rally and supply Bitcoin with the assist they should problem the very best ever earlier than.

Adjustments to Bitcoin Hodler Internet place. Supply: GlassNode

BTC costs are excessive

On the time of writing, Bitcoin is buying and selling at $120,290 and is making an attempt to safe $120,000 as a assist ground. Holding this degree is vital to keep up momentum and forestall short-term reversals.

The instant problem for BTC is $122,000, which exists as a remaining resistance past the all-time excessive of $124,474. A profitable breakout that crosses this barrier opens the door for Bitcoin to chart new ATHs and strengthens bullish beliefs throughout the market.

Bitcoin worth evaluation. Supply: TradingView

Nevertheless, if the market situations weaken and gross sales stress rises, Bitcoin dangers shedding $120,000 in assist. In such a state of affairs, the worth might slip to $117,261. This can override bullish papers and inform you of a short lived pause on the assembly.

Demand for brand new Bitcoin will emerge as its worth is $120,000. Subsequent – A brand new ATH was first launched in Beincrypto.