Regardless of the nominal energy of the U.S. financial system, exemplified by the S&P 500’s 16% rise in 2025, the previous yr has proven a sequence of warning indicators. One of the seen indicators of the seriousness of the issue is the variety of bankruptcies amongst giant firms, which has reached its highest degree since 2010.

Particularly, 717 main U.S. firms will file for chapter in 2025, a rise of 4.37% from 687 firms in 2024. Moreover, this determine is 12.21% larger than in the course of the 2020 coronavirus pandemic and the very best quantity since 2010, when 828 firms went bankrupt.

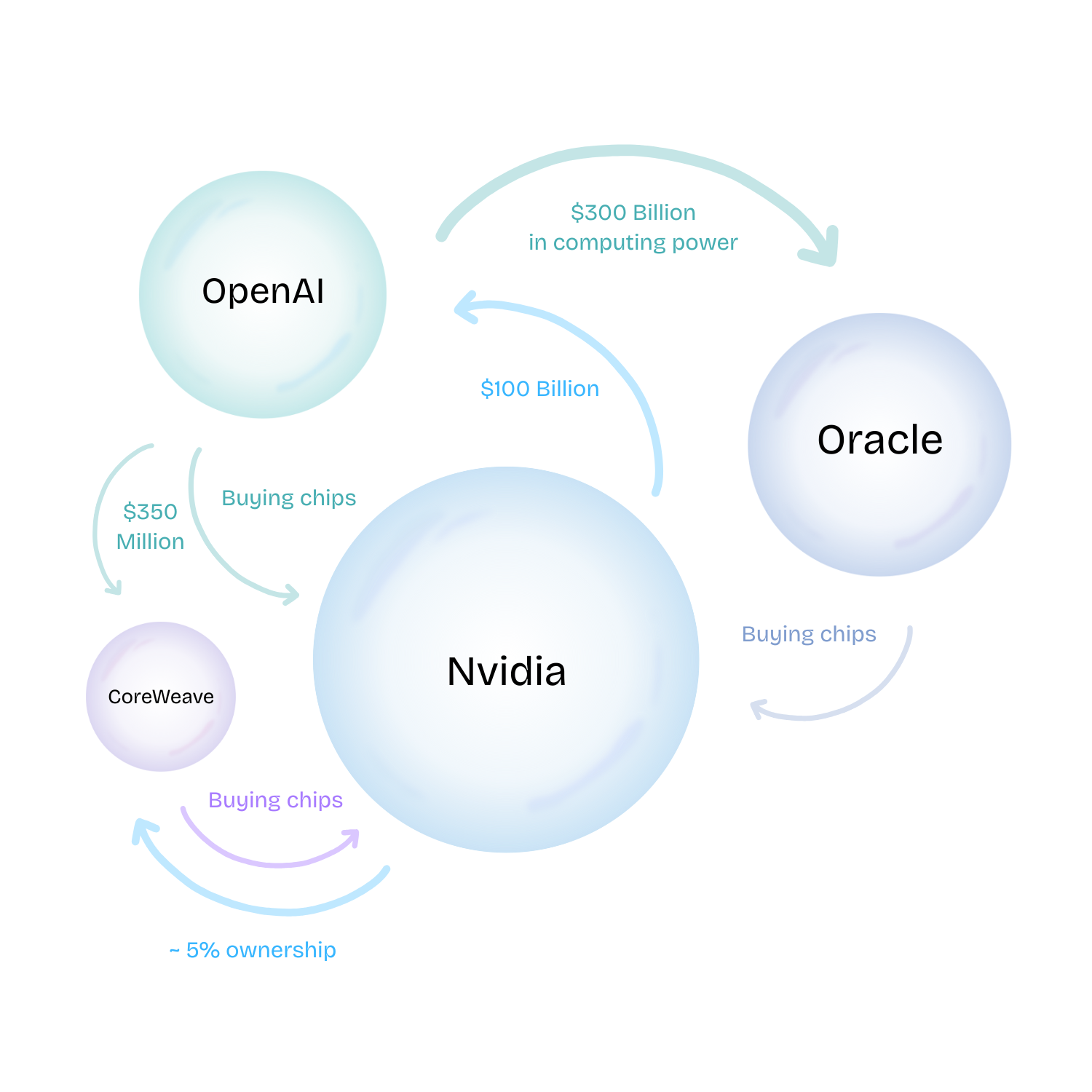

In truth, present patterns of company funding appear to be firms like Nvidia and Microsoft (NASDAQ: MSFT) subsidizing smaller firms like OpenAI and Anthropic to purchase their services and products.

Though the variety of bankruptcies is rising yr by yr, it stays beneath the disaster degree.

But, regardless of years of predictions for a giant crash and a refrain of voices warning that the “AI bubble” is about to burst all through 2025, the American inventory market continues to make progress, and even the rise in bankruptcies dwarfs the disaster years of 2008 and 2009, when there have been 5,336 and 5,026 such filings.

Equally, whereas many draw parallels between the present state of the financial system and the dot-com bubble, some analysts level out that the monetary energy of the businesses driving the AI increase is not like something seen within the Nineteen Nineties, that means they’re possible to have the ability to soak up any potential shocks.

Nonetheless, the actions of a number of traditionally profitable traders are trigger for concern. Remarkably, essentially the most well-known winner of the Nice Recession, Michael Burry, predicted the disaster and invested accordingly.

Warren Buffett spent his final yr as CEO of Berkshire Hathaway (NYSE: BRK.A, BRK.B) rising the corporate’s money reserves to document ranges on the expense of investing in shares.

Featured picture through Shutterstock