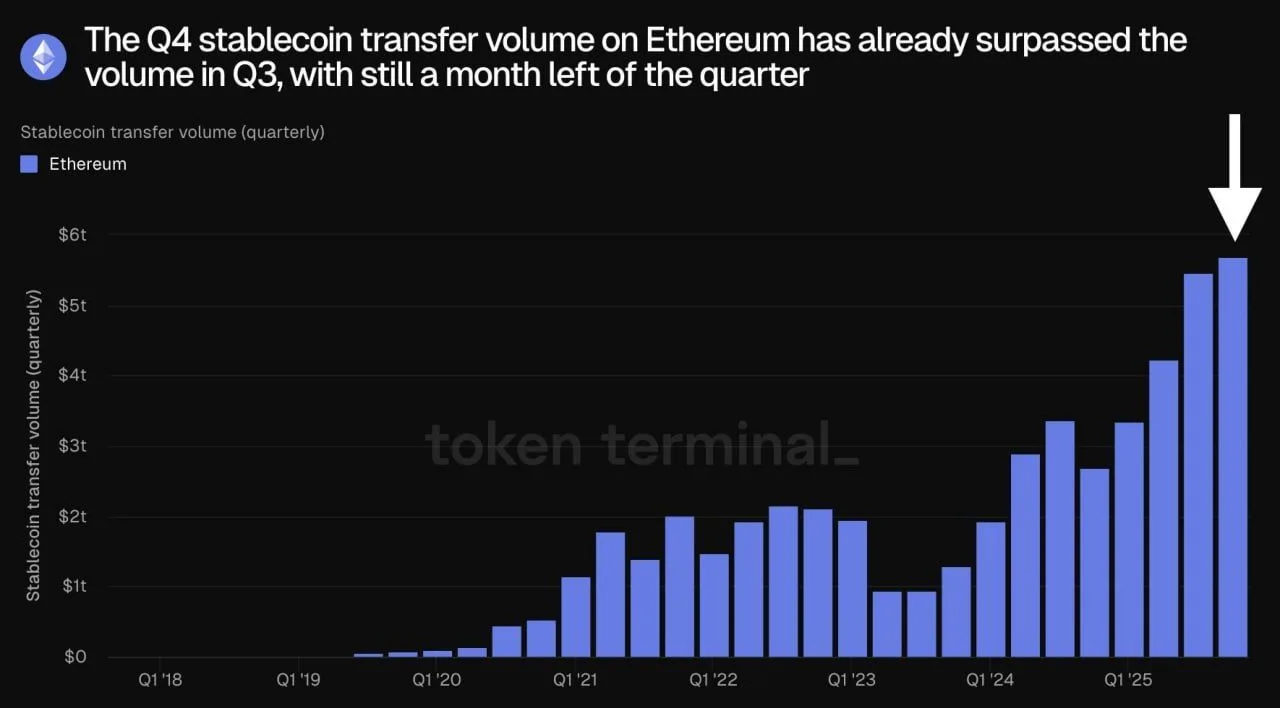

Ethereum has proven two main indicators this quarter: report stablecoin cost flows and a brand new long-term accumulation sample highlighted by market analysts. In line with the most recent knowledge from Token Terminal, stablecoin transfers within the fourth quarter reached almost $6 trillion, already exceeding the earlier quarter’s complete with just a few weeks left.

On the similar time, chart analysts say Ethereum’s multi-year construction is transferring right into a Wyckoff accumulation section, reflecting quiet positioning behind the scenes because the market resets after the 2022-2023 selloff.

Ethereum stablecoin buying and selling quantity approaches $6 trillion in This fall

Ethereum is on tempo to course of round $6 trillion in stablecoin transfers through the fourth quarter, in response to new knowledge from Token Terminal. This chart reveals that This fall exercise is already above Q3 ranges, though the quarter shouldn’t be over but. This marks one of the lively intervals for Ethereum on-chain funds, as demand for stablecoin transfers continues to speed up throughout DeFi and alternate infrastructure.

Ethereum stablecoin switch quantity (quarterly). sauce: token terminal

This quantity additionally signifies that Ethereum exceeds the newest quarterly buying and selling volumes reported by Visa and Mastercard. Though the networks measure conventional cost exercise and Ethereum tracks on-chain switch quantity, the distinction in measurement this quarter continues to be notable. This highlights how a lot worth is presently transferring by way of blockchain rails as stablecoins change into the popular cost device for transactions, remittances, and institutional flows.

The surge in exercise strengthens Ethereum’s place because the main cost surroundings for stablecoins. USDT, USDCand different dollar-pegged tokens accounted for the majority of the amount, pushed by elevated utilization throughout decentralized exchanges, lending swimming pools, and cross-chain bridges. Though there may be nonetheless a month left within the quarter, analysts anticipate the ultimate numbers for the fourth quarter to be the Ethereum stablecoin’s largest buying and selling quantity ever.

Analyst maps Ethereum to new Wyckoff accumulation section

Crypto GEMs claims that Ethereum has entered a brand new accumulation zone below the Wyckoff market cycle framework, primarily based on a long-term worth chart that labels earlier worth appreciation, distribution, worth decline, and accumulation phases. The present vary follows the decline in 2022-2023, which analysts are treating because the final pullback earlier than the underlying development resets.

Ethereum Wyckoff cycle phases. sauce: Crypto GEM/TradingView

In line with this evaluation, the flat construction after 2023 displays an precedent days when giant corporations had been quietly positioning themselves forward of a powerful breakthrough. Cryptocurrency GEM says that previous cycles on the chart point out {that a} comparable accumulation block existed forward of a powerful markup leg and that new advances might ultimately result in Ethereum Towards $20,000 territory by 2026.

The submit notes that sentiment stays divided, with skeptical merchants viewing the vary as depleted, whereas extra optimistic holders see it as a possibility to extend publicity. The Wyckoff markup section stays depending on widespread liquidity, macro situations, and sustained demand for the Ethereum community and functions.