In cryptocurrencies, performing early can in all probability repay huge. This definitely appears to be the case with Ripple Labs, a San Francisco-based blockchain firm presently price greater than $40 billion.

And whereas the corporate has been at odds with the SEC for years, the regulatory atmosphere has improved significantly since President Trump took workplace. For the reason that US presidential election, the worth of XRP, the altcoin Ripple launched again in 2012, has been hovering above $2, a value vary not seen because the 2017 blockchain bull market.

However are there any actual use instances for XRP?

XRP Cost Hall

Hedy Wang, CEO of crypto liquidity supplier Block Avenue, stated that whereas Ripple’s footprint within the US might now develop, it already has momentum in different elements of the world.

““Within the US, there have been extra constraints due to the entire SEC dynamic, so the main target has been skewed towards retail shops and offshore venues. Traditionally, we have seen vital XRP traction in Japan, elements of East Asia, and a few areas with excessive remittances just like the Philippines and Latin America through companions,” Wang advised BeInCrypto.

What’s plain is that buyers have been buying XRP over the previous 12 months. Since Trump was elected in November 2024, the worth of XRP has elevated 330% from $0.50 to $2.15.

XRP value efficiency since November 2024. supply: CoinGecko

“Bitcoin is taken into account ‘digital gold,’ and Ethereum is understood for its sensible contracts,” stated Gregory Monaco, an authorized public accountant who runs a CPA agency with the identical identify. “The worth of XRP comes from cross-border funds.”

Monaco cited Ripple’s 300 monetary companions in 45 nations and annual cross-border funds quantity of $15 billion as key indicators of Ripple’s use case.

Due to this fact, it’s potential that firms working cryptocurrencies comparable to Ripple will make investments precise personnel and work on realizing necessary cost channels.

“XRP can survive as a distinct segment monetary conduit if Ripple continues to build up licenses and financial institution/fintech integrations,” Block Avenue’s Wang added.

Crossing borders shouldn’t be so easy

The time period “cross-border funds” could sound like company jargon. However ask anybody who has despatched cash from one nation to a different, and it is clear that it is a problematic course of. It could be late. May be costly.

As well as, additionally, you will have to change international forex. Cryptocurrencies like XRP are borderless, world, and low cost. There’s worth in decreasing reliance on TradFi’s common cost system.

Working at Airbnb helped Coinbase’s Armstrong perceive cross-border funds. sauce: ×

Nonetheless, “hopium” alone does not essentially imply XRP’s valuation is so intently tied to its funds use case, notes Paul Holmes, a researcher at BrokerListings.

“XRP remains to be very a lot a speculative asset,” Holmes advised BeInCrypto. “For cryptocurrencies as a complete, their valuations should not supported by their very own income sources and are subsequently a operate of liquidity manufacturing and reallocation from different shops of worth.”

Crypto buyers and OG whales could merely be accumulating extra XRP, as Ripple Labs, the biggest investor within the cryptocurrency, seems to be a reasonably well-performing crypto firm.

Ripple’s latest inflow of $500 million in capital from Fortress Funding Group and Citadel Securities at a valuation of $40 billion definitely displays that.

XRP as an ETF catalyst

Lately, UK-based CoinShares withdrew from launching a US XRP ETF product, which might probably improve demand from buyers sticking to public markets.

“CoinShares probably pulled out as a result of the SEC hasn’t made it regulatory clear that XRP is ETF-compatible,” stated BrokerListings’ Holmes.

It is very important remember that CoinShares additionally determined to not launch an ETF for Solana or Litecoin. As such, XRP shouldn’t be alone within the hesitance to launch merchandise backed by these cryptocurrencies.

“XRP is already getting used to maneuver worth between currencies, stablecoins, and the rising variety of tokenized monetary belongings on the community,” stated Raquel Amanda, senior communications lead at Ripple. “Because the ecosystem grows, the necessity for quick and impartial funds will develop, and we consider XRP will naturally proceed to fill that function.”

In response to knowledge from CoinGecko, the worth of XRP has elevated greater than 36,000% because it was first listed on the change on August 3, 2013.

Historic value efficiency knowledge for the XRP cryptocurrency. sauce: CoinGecko

However the irony of speculative belongings getting used to pay shouldn’t be misplaced on BrokerListings’ Properties.

“On-chain exercise reveals that there are 50 million to 55 million XRP transactions per 30 days, nearly all of that are funds,” he famous. “On the identical time, XRP remains to be utilized by many as a extra speculative asset than sensible, and can’t be relied upon as a dependable retailer of worth.”

Rift to the moon?

Though it might appear complicated to make use of a unstable asset like XRP as a cost rail, it is very important keep in mind that many cryptocurrencies like XRP are extremely divisible and quick.

XRP is actually “programmable cash.” You’ll be able to implement code that makes use of the quantity of XRP you need primarily based on the present buying and selling value.

And for high-end institutional funds the place XRP is used, it does not actually matter what the backend appears to be like like so long as the cash will get to its vacation spot.

Whereas stablecoins could also be standard for client use and transactions, XRP serves as a sort of logistics funds switch car for firms that have to switch worth globally.

This explains why, in keeping with Monaco Chartered Accountants, 58% of the exercise on the community originates from simply 10 wallets.

This use case, together with the aborted battle between Ripple Labs and the SEC, is probably going the premise for a bullish narrative.

By early 2024, there have been over 5 million XRP wallets on the community. After Trump’s victory, on November 13, 2024, the securities app Robinhood relisted XRP on its app.

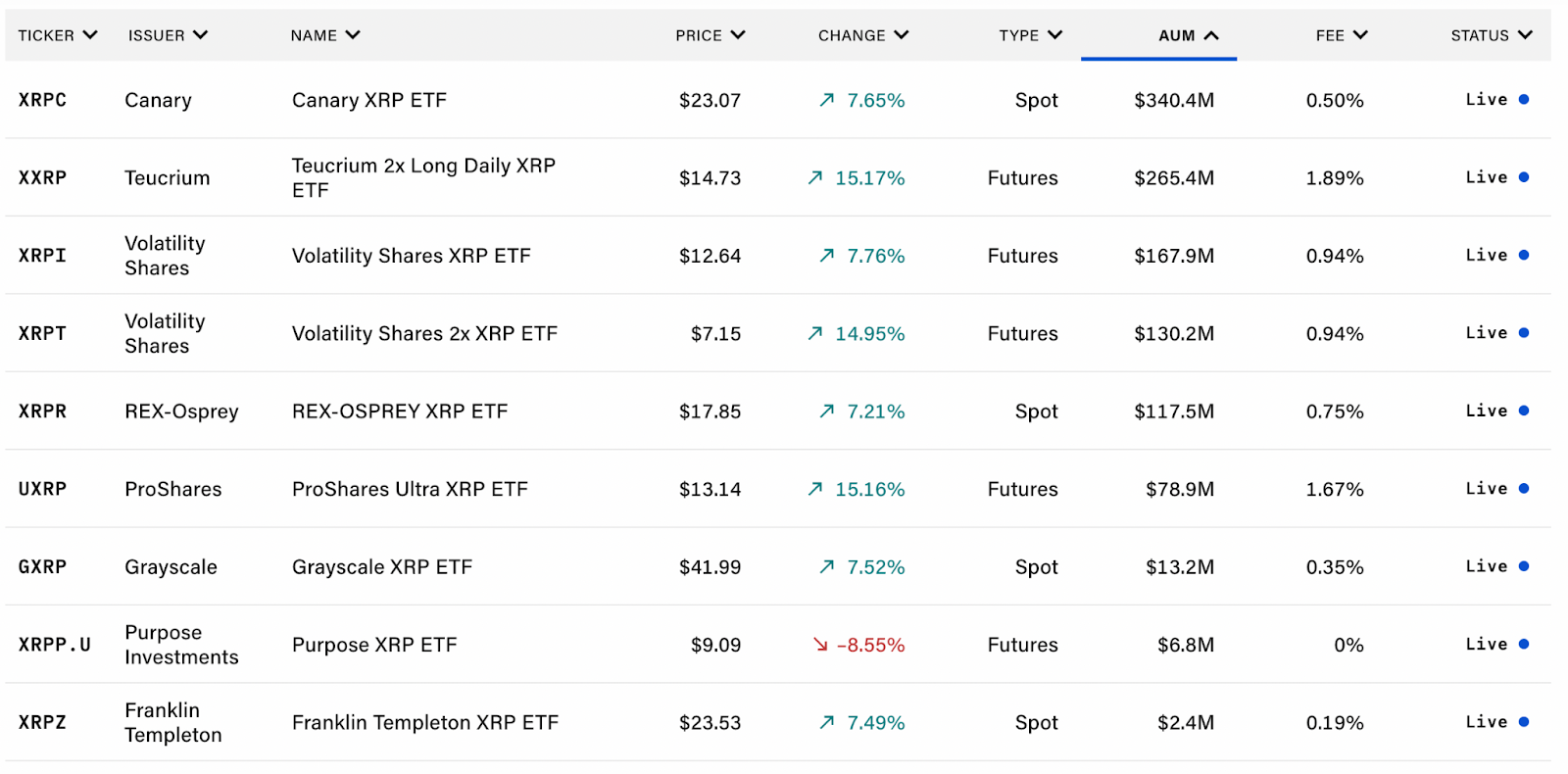

An inventory of XRP ETF merchandise already working on the general public market.

In Could 2025, Ripple Labs agreed to a $50 million judgment in a dispute with the SEC, ending a years-long quagmire that probably held again XRP for a while.

Additionally, XRP does not essentially want a CoinShares ETF, as there are already 9 dwell merchandise available on the market with $1.1 billion in whole belongings below administration (AUM).

Sure, the XRP legion (because the chain’s avid buyers wish to name it) believes there are various causes to be hopeful concerning the future, with far much less draw back danger than ever earlier than.

Submit-XRP is up 330% since President Trump’s election, however what good does it actually do? The put up appeared first on BeInCrypto.