In April 2023, Bitconnor, who went beneath the title of Bledman, purchased the property for $496,000. This was equal to 22.5 BTC on the time. Quick ahead to August 2025, the property is at present valued at $570,000, a decent revenue of 15% on the greenback phrases. However here is the kicker. Bitcoin worth, his house is now price simply 4.85 BTC, a staggering 78% loss when measured in opposition to the world’s most troublesome cash, highlighting the quiet crash of actual property as a storage asset.

Bledman’s painful private anecdote, disguised as an increase in Fiat costs, reveals a quiet disaster that wavys throughout the worldwide actual property market, which is broad open when seen by way of the Bitcoin lens.

Quiet crashes in actual property are extra pronounced within the US

Mediterranean international locations like Spain report annual worth progress at 7-8%, and the broader international image is extra unsure, even with double-digit jumps of worth worth valued in Portugal.

In North America, the UK, and lots of different elements of Europe, the tempo of property viewing has slowed down dramatically. UBS International Forecast for 2025 predicts capital worth can be “pretty flat” this 12 months after a decline in 2022 and a gentle restoration, with the housing sector exhibiting solely “conservative uplifts.”

Fiat Erosion: Why are actual income not seen?

On paper, it seems like a 15% enhance over two years is stable. Nonetheless, inflation is digging into the lent of these Fiat income. The revised forecast pinned US inflation in 2025 as greater than 4%. Including native volatility from tariffs and international coverage modifications usually signifies that the true revenue margin on property is way decrease than the headline figures.

It deteriorates in lots of rising markets, with excessive inflation (typically three digits) wiping out nominal income and even eroding true wealth. For instance, Argentina’s annual inflation exceeded 200% in 2023. In different phrases, property house owners usually noticed a rise within the forex worth of areas utterly hidden by dramatic losses in bought electrical energy.

Bitcoin: The Final Measurement Stick

Zoom out. Since April 2023, Bitcoin has skyrocketed from ~$22,000 to over $118,000, surpassing all main asset courses on the planet, and has warned the income of {dollars} made in actual property. The home could also be dearer in Fiat, nevertheless it’s very low cost from a BTC standpoint.

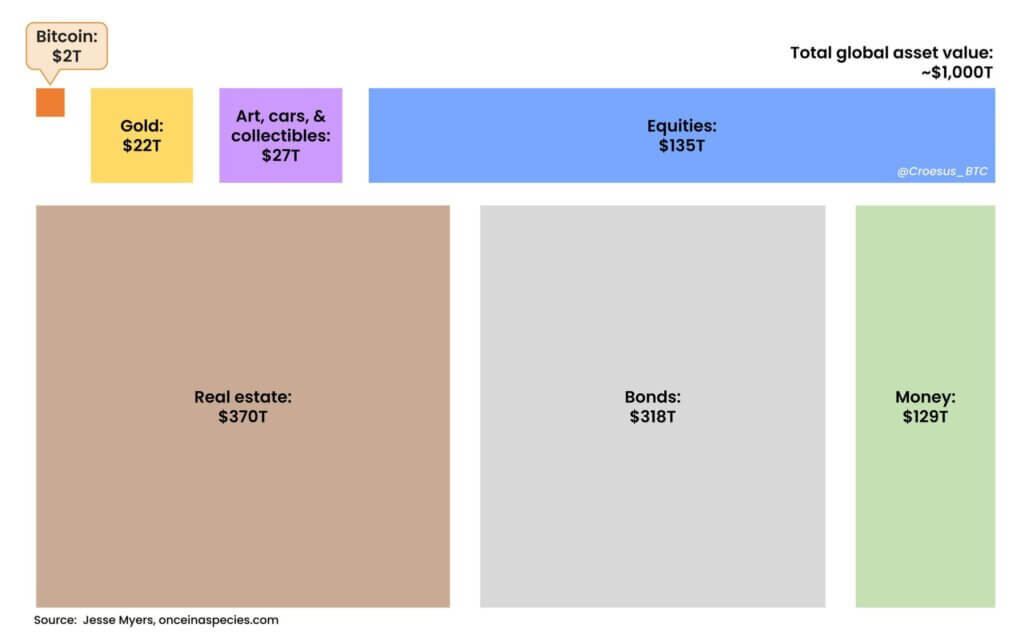

Macro investor and Bitcoin advocate James Rabish has known as for the most important addressable asset class and international actual property for wealth searching for inflation safety. He highlighted $998 trillion in capital parked in actual property and different international property. All of those have steadily misplaced their place in Bitcoin’s rarity-driven deflation mannequin.

A home appears like an excellent funding in nominal charts, however when measured in opposition to true arduous cash, it breaks down the precise buying energy.

“Bitcoin Pizza” Impact: When Worth turns into a Parabolic

Exchangeing Bitcoin for different property has confirmed to be extraordinarily costly through the years. Ask Laszlo Hanyecz, who traded 10,000 BTC for 2 pizzas in 2010. On the time, the coin was price round $41. Right this moment, these pizzas earn greater than $1.1 billion. What seems to be affordable in Fiat’s terminology has turn out to be a legendary loss within the worth of Bitcoin, and a warning substance for many who measure wealth with the greenback alone.

International headlines promote resilient issues and even rising actual property costs, however a brand new actuality is rising for individuals with a bitcoin perspective. It crashes very a lot from the angle of actual property BTC, and inflation additional erodes Fiat’s income.